It’s an obvious assumption that insurance companies don’t want their policyholders to compare prices. Insureds who compare rates at least once a year will presumably switch car insurance companies because of the high probability of finding a policy with more affordable rates. Surprisingly, a recent survey revealed that people who compared rates once a year saved $865 annually as compared to drivers who never compared rates.

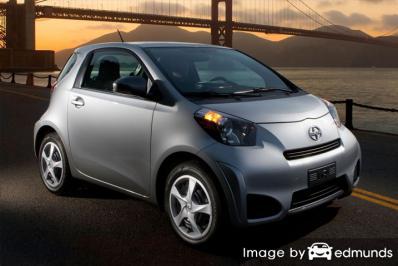

If finding the best price on Scion iQ insurance in Durham is your objective, then having some insight into the best ways to shop for insurance premiums can make the process more efficient.

Truthfully, the best way to save money on auto insurance rates is to compare prices regularly from insurers in Durham.

Truthfully, the best way to save money on auto insurance rates is to compare prices regularly from insurers in Durham.

First, spend some time learning about what coverages are included in your policy and the factors you can control to keep rates down. Many things that cause rate increases such as inattentive driving and a low credit score can be controlled by making minor changes in your lifestyle. Later in this article we will cover additional tips to prevent rate hikes and find discounts that may have been missed.

Second, request price quotes from direct, independent, and exclusive agents. Exclusive agents and direct companies can provide rates from one company like GEICO or State Farm, while agents who are independent can provide rate quotes from multiple sources.

Third, compare the new rate quotes to your current policy premium to see if you can save by switching companies. If you find better rates, make sure there is no lapse in coverage.

One thing to remember is that you’ll want to make sure you compare identical coverages on every quote request and and to get price quotes from as many companies as feasibly possible. This ensures an apples-to-apples comparison and a thorough selection of prices.

Cutting your car insurance rates is actually quite simple. You just need to take a few minutes comparing price quotes from different insurance companies.

The companies in the list below offer quotes in North Carolina. To find the best cheap auto insurance in NC, we suggest you click on several of them in order to find the most affordable rates.

Car insurance quotes and discounts

Car insurance companies don’t always list every discount they offer in a way that’s easy to find, so the list below gives a summary of a few of the more common as well as some of the hidden credits available to you.

- Discount for Life Insurance – Not every insurance company offers life insurance, but if they do you may earn a discount if you purchase life insurance.

- Distant Student Discount – College-age children who live away from home at college and won’t have access to an insured vehicle can be insured at a reduced rate.

- Government Employee Discount – Being employed by or retired from a federal job may reduce rates when you quote Durham auto insurance with select insurance companies.

- Passive Restraint Discount – Options like air bags or motorized seat belts may earn rate discounts of 25 to 30%.

- Military Discounts – Having a family member in the military could be rewarded with lower rates.

- Switch and Save Discount – Some larger companies provide a discount for switching companies early. You can save around 10% with this discount.

- No Claims – Insureds who avoid accidents and claims can save substantially compared to drivers who are more careless.

- Smart Student Discounts – This discount can save 20 to 25%. Most companies allow this discount up until you turn 25.

- Low Mileage Discounts – Driving fewer miles could earn cheaper car insurance rates.

- Safe Driver Discount – Insureds who avoid accidents could pay up to 40% less as compared to drivers with claims.

We need to note that some credits don’t apply to the entire policy premium. The majority will only reduce the price of certain insurance coverages like liability, collision or medical payments. If you do the math and it seems like you could get a free car insurance policy, nobody gets a free ride.

The best car insurance companies and a selection of discounts include:

- State Farm discounts include student away at school, driver’s education, accident-free, safe vehicle, and multiple autos.

- American Family may have discounts that include mySafetyValet, early bird, defensive driver, TimeAway discount, and good driver.

- AAA offers discounts including education and occupation, multi-policy, AAA membership discount, multi-car, anti-theft, good driver, and good student.

- GEICO offers discounts for membership and employees, federal employee, daytime running lights, defensive driver, and anti-theft.

- Mercury Insurance includes discounts for multi-car, annual mileage, age of vehicle, location of vehicle, low natural disaster claims, and type of vehicle.

- Farmers Insurance may include discounts for good student, electronic funds transfer, bundle discounts, youthful driver, and mature driver.

- Progressive has savings for homeowner, multi-policy, online signing, multi-vehicle, online quote discount, good student, and continuous coverage.

Before buying, ask every company to apply every possible discount. Some discounts listed above might not apply everywhere. If you would like to see a list of insurers that offer many of these discounts in Durham, click this link.

Shop online but buy locally

Certain consumers prefer to get professional advice from a licensed agent and that is just fine! Licensed agents are very good at helping people manage risk and help in the event of a claim. One of the benefits of comparing car insurance online is that you can find cheap car insurance quotes but also keep your business local. And buying from local insurance agents is especially important in Durham.

To help locate an agent, after submitting this short form, your coverage information is transmitted to insurance agents in Durham who will gladly provide quotes for your coverage. There is no reason to contact any agents since rate quotes are delivered to your email. If you have a need to get a rate quote from a particular provider, you would need to go to their quote page and fill out the quote form the provide.

To help locate an agent, after submitting this short form, your coverage information is transmitted to insurance agents in Durham who will gladly provide quotes for your coverage. There is no reason to contact any agents since rate quotes are delivered to your email. If you have a need to get a rate quote from a particular provider, you would need to go to their quote page and fill out the quote form the provide.

Finding the right company needs to be determined by more than just the quoted price. Agents should be asked these questions:

- Is there a Errors and Omissions policy in force?

- Are they properly licensed to sell insurance in North Carolina?

- How are claims handled?

- Will their companies depreciate repairs to your car based on the mileage?

- What are the financial ratings for the companies they represent?

- Does their agency support local causes in Durham?

- What companies can they write with?

- What company holds the largest book of business for them?

Why Your Insurance Rates might be higher

Many different elements are part of the calculation when you quote your car insurance policy. A few of the factors are predictable like an MVR report, but other criteria are not as apparent like where you live or how safe your car is.

Shown below are some of the factors used by your company to calculate your premiums.

Your stress level may be raising your premiums – Careers such as judges, business owners, and medical professionals tend to pay higher average rates attributed to job stress and extremely grueling work hours. On the other hand, professions such as professors, engineers and the unemployed receive lower rates.

Gender as a rate factor – Statistics show women tend to be less risk to insure than men. The data does not necessarily mean that women are better drivers. Both sexes are responsible for at-fault accidents in similar numbers, but the men tend to have more serious accidents. Men also get cited for more serious violations like DWI (DUI) or reckless driving. Young males cause the most accidents and thus pay the highest rates.

Multi-policy discounts can save money – Most major companies provide better rates to people who carry more than one policy such as combining an auto and homeowners policy. Discounts can amount to ten percent or more. If you currently are using one company, it’s in your best interest to compare other Durham iQ insurance rates to help ensure you have the lowest rates. You may still be able to find a better deal by buying auto insurance from a different company.

Having a spouse equates to better rates – Being married may earn you lower rates on your auto insurance bill. Having a significant other means you’re less irresponsible and insurance companies reward insureds because married drivers get in fewer accidents.

High credit score translates to low premiums – Credit history can be an important factor in calculating your auto insurance rates. Consumers who have good credit tend to file fewer claims as compared to drivers with bad credit. If your credit is lower than you’d like, you could save money insuring your Scion iQ by spending a little time repairing your credit.

Scion iQ insurance loss data – Companies take into consideration historical loss data for every vehicle to determine a price that will be profitable for them. Models that statistically have higher loss trends will have a higher premium rate.

The next table shows the actual insurance loss data for Scion iQ vehicles. For each policy coverage type, the loss probability for all vehicles, as a total average, is equal to 100. Numbers shown that are under 100 indicate a favorable loss history, while numbers shown that are more than 100 indicate frequent claims or tendency to have larger claims.

| Specific Scion Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Scion iQ | 77 | 81 | 75 |

Empty fields indicate not enough data collected

Statistics from IIHS.org for 2013-2015 Model Years

Choosing Scion iQ insurance is an important decision

Despite the high cost of buying insurance for a Scion iQ in Durham, insurance is most likely required but also gives you several important benefits.

First, just about all states have minimum mandated liability insurance limits which means state laws require specific limits of liability protection in order to drive the car. In North Carolina these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

Second, if you took out a loan on your iQ, almost every bank will force you to have insurance to ensure they get paid if you total the vehicle. If you do not keep the policy in force, the lender may have to buy a policy to insure your Scion at an extremely high rate and make you pay the higher price.

Third, insurance preserves both your assets and your Scion. It also can pay for medical expenses that are the result of an accident. One policy coverage, liability insurance, will also pay for a defense attorney if you are sued as the result of an accident. If damage is caused by hail or an accident, comprehensive (other-than-collision) and collision coverage will pay all costs to repair after the deductible has been paid.

The benefits of having insurance outweigh the cost, especially with large liability claims. An average driver in America is overpaying more than $750 every year so compare rate quotes at least once a year to make sure the price is not too high.

Compare car insurance rates regularly to save

As you prepare to switch companies, it’s not a good idea to sacrifice coverage to reduce premiums. There are a lot of situations where an accident victim reduced collision coverage and discovered at claim time that it was a big error on their part. The goal is to get the best coverage possible at an affordable rate, but do not sacrifice coverage to save money.

People switch companies for many reasons like not issuing a premium refund, policy cancellation, high rates after DUI convictions or poor customer service. It doesn’t matter why you want to switch choosing a new company is pretty simple and you could end up saving a buck or two.

Cheaper Scion iQ insurance in Durham can be sourced from both online companies in addition to many Durham insurance agents, so get free Durham auto insurance quotes from both of them in order to have the best chance of saving money. Some car insurance companies may not provide price quotes online and many times these regional insurance providers only sell coverage through local independent agencies.

For more information, take a look at the resources below:

- How do I File a Claim? (Insurance Information Institute)

- Who Has Cheap Auto Insurance for Good Students in Durham? (FAQ)

- Who Has the Cheapest Car Insurance for a Honda CR-V in Durham? (FAQ)

- Who Has the Cheapest Car Insurance Rates for Teenage Males in Durham? (FAQ)

- Uninsured Motorists: Threats on the Road (Insurance Information Institute)

- Teen Driver Licensing Information (iihs.org)

- Get the Right Protection (InsureUonline.org)

- Rental Reimbursement Coverage (Allstate)