Astonishing but true, a large majority of drivers kept their policy with the same company for well over three years, and about 40% of consumers have never even compared quotes to find affordable rates. With the average premium in the United States being $1,847, drivers could cut their rates by roughly 47% a year just by getting comparison quotes, but they just don’t understand the amount of savings they would get if they switched to a cheaper policy.

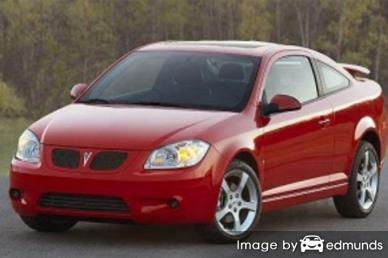

The best way we recommend to find affordable quotes for Pontiac G5 insurance is to make a habit of regularly comparing prices from providers who provide auto insurance in Durham.

The best way we recommend to find affordable quotes for Pontiac G5 insurance is to make a habit of regularly comparing prices from providers who provide auto insurance in Durham.

- Step 1: Take a little time to learn about what is in your policy and the things you can change to prevent expensive coverage. Many factors that result in higher prices such as at-fault accidents, speeding tickets, and a low credit rating can be controlled by paying attention to minor details. This article provides tips to help keep prices low and find additional discounts.

- Step 2: Compare price quotes from exclusive agents, independent agents, and direct providers. Exclusive agents and direct companies can only give prices from a single company like GEICO or State Farm, while independent agents can quote rates from multiple companies.

- Step 3: Compare the new rate quotes to your current policy to see if you can save by switching companies. If you find a lower rate and switch companies, make sure the effective date of the new policy is the same as the expiration date of the old one.

- Step 4: Notify your agent or company to cancel your current policy. Submit the required down payment along with the signed application for your new coverage. Be sure to put the new certificate verifying proof of insurance with your registration paperwork.

One important bit of advice is to use the same liability limits and deductibles on each quote and and to get quotes from as many different companies as possible. Doing this provides a fair rate comparison and the best price quote selection.

When looking for affordable Durham auto insurance quotes, there are a couple ways to compare quotes from different companies. The quickest method to find competitive insurance rates is to use the internet to compare rates.

It’s so easy to compare rates online that it makes it a waste of time to physically go to different Durham agent offices. Doing it all online eliminates the middleman unless you have a complicated situation and need the trained advice of a licensed agent. However, consumers can obtain prices from the web but have your policy serviced through an agent. When comparing auto insurance rates, know that comparing more prices helps increase your odds of locating a lower rate than you’re paying now. Some regional insurers cannot provide Durham G5 insurance quotes online, so you should also compare price estimates from the smaller companies as well.

The following companies can provide free quotes in North Carolina. To find cheaper car insurance in Durham, NC, it’s highly recommended you visit as many as you can in order to find the most affordable rates.

Why you need to buy insurance

Even though Durham G5 insurance rates can get expensive, maintaining insurance may be mandatory for several reasons.

- Almost all states have compulsory liability insurance requirements which means the state requires specific minimum amounts of liability if you want to drive legally. In North Carolina these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you bought your G5 with a loan, it’s guaranteed your bank will make it mandatory that you buy insurance to ensure they get paid if you total the vehicle. If coverage lapses or is canceled, the bank will be required to insure your Pontiac for a lot more money and force you to pay the higher premium.

- Insurance preserves not only your car but also your assets. Insurance will pay for most medical and hospital costs for not only you but also any passengers injured in an accident. Liability coverage also covers legal expenses if anyone sues you for causing an accident. If damage is caused by hail or an accident, comprehensive (other-than-collision) and collision coverage will pay to repair the damage minus the deductible amount.

The benefits of buying insurance greatly outweigh the cost, particularly when you have a large claim. But the average American driver is wasting up to $855 a year so we recommend shopping around at every policy renewal to ensure rates are competitive.

Companies offer many types of discounts on Pontiac G5 insurance in Durham

Auto insurance companies don’t list every discount available in an easy-to-find place, so the list below details both the well known as well as some of the hidden credits available to you.

- Paperless Signup – Some of the larger companies may give you up to $50 for completing your application on your computer.

- Good Student Discount – Being a good student can earn a discount of 20% or more. The discount lasts well after school through age 25.

- Low Mileage – Driving fewer miles can qualify you for better insurance rates on cars that stay parked.

- Waiver for an Accident – Not a discount per se, but certain companies may permit one accident before raising your premiums if you are claim-free prior to the accident.

- Club Memberships – Affiliation with a civic or occupational organization in Durham is a good way to get lower rates when shopping for insurance.

- Discount for Life Insurance – Insurance companies who offer life insurance give a lower rate if you buy a life insurance policy as well.

We need to note that some of the credits will not apply to the whole policy. Most only apply to the price of certain insurance coverages like physical damage coverage or medical payments. Even though the math looks like it’s possible to get free car insurance, nobody gets a free ride.

Companies and their possible discounts include:

- Farmers Insurance may offer discounts for multi-car, business and professional, good student, mature driver, distant student, and early shopping.

- State Farm policyholders can earn discounts including multiple policy, driver’s education, Drive Safe & Save, Steer Clear safe driver discount, anti-theft, student away at school, and accident-free.

- Liberty Mutual discounts include preferred payment discount, safety features, hybrid vehicle, teen driver discount, exclusive group savings, and good student.

- MetLife includes discounts for multi-policy, defensive driver, good driver, claim-free, and good student.

- Progressive may include discounts for homeowner, multi-vehicle, online signing, online quote discount, good student, continuous coverage, and multi-policy.

Before purchasing a policy, check with each insurance company which discounts can lower your rates. Discounts may not be offered in Durham. For a list of insurance companies with significant discounts in Durham, click here to view.

Insurance agencies near you

Some consumers still prefer to sit down and talk to an agent and doing so can bring peace of mind The biggest benefit of price shopping on the web is that drivers can save money and get lower rates and still choose a local agent. Buying from local agents is still important in Durham.

After filling out this quick form, your coverage information is instantly submitted to local insurance agents that can provide free Durham auto insurance quotes for your business. You don’t have to contact any agents because quoted prices will be sent to you directly. You can most likely find cheaper rates without requiring a lot of work. If you wish to get a comparison quote for a specific company, you just need to search and find their rate quote page and give them your coverage information.

After filling out this quick form, your coverage information is instantly submitted to local insurance agents that can provide free Durham auto insurance quotes for your business. You don’t have to contact any agents because quoted prices will be sent to you directly. You can most likely find cheaper rates without requiring a lot of work. If you wish to get a comparison quote for a specific company, you just need to search and find their rate quote page and give them your coverage information.

The type of car insurance agent you choose is important

If you are wanting to find a reliable agent, it’s helpful to know the different types of agents and how they can quote your rates. Agents in Durham can be classified as either independent or exclusive.

Independent Agents (or Brokers)

These agents are normally appointed by many insurers and that enables them to quote your coverage with lots of companies and find you the best rates. If your premiums go up, they simply switch companies in-house and you can keep the same agent. When comparison shopping, you need to get quotes from several independent insurance agents to get the most accurate price comparison.

Listed below is a short list of independent insurance agencies in Durham that may be able to provide price quotes.

The Sorgi Insurance Agency

16 Consultant Pl Suite 102 – Durham, NC 27707 – (919) 682-4814 – View Map

Bull City Insurance

121 Sherron Rd #302 – Durham, NC 27703 – (919) 596-0671 – View Map

Superior Insurance of Durham

3825 S Roxboro St #118 – Durham, NC 27713 – (919) 224-8034 – View Map

Exclusive Agencies

Exclusive agencies can only quote rates from one company and examples are AAA, State Farm, Farmers Insurance, and Allstate. They are unable to give you multiple price quotes so they have to upsell other benefits. Exclusive insurance agents are trained well on their company’s products and that allows them to sell at a higher price point.

Below are Durham exclusive insurance agencies who can help you get rate quotes.

Jeff Stephenson – State Farm Insurance Agent

8200 Renaissance Pkwy #1004 – Durham, NC 27713 – (919) 572-1702 – View Map

Farm Bureau Insurance

4021 Stirrup Creek Dr #220a – Durham, NC 27703 – (919) 469-3191 – View Map

Tracey Stidham – State Farm Insurance Agent

3622 Shannon Rd #102 – Durham, NC 27707 – (919) 401-6147 – View Map

Choosing the best car insurance agent requires more thought than just the bottom line cost. These are some valid questions you should ask.

- How are they compensated?

- What is their Better Business Bureau rating?

- Is assistance available after office hours?

- By raising physical damage deductibles, how much would you save?

- Will your rates increase after a single accident?

- How many years have they been established?

When to get professional advice

When it comes to buying coverage online or from an agent for your personal vehicles, there really is not a perfect coverage plan. Your situation is unique and your auto insurance should unique, too.

For example, these questions might point out whether you could use an agent’s help.

- Is my custom stereo system covered?

- Is business equipment covered while in my vehicle?

- Can I pay claims out-of-pocket if I buy high deductibles?

- Is a new car covered when I drive it off the dealer lot?

- Can I get by with minimal medical coverage if I have good health insurance?

- Do they offer discounts for home and auto coverage?

- When should I have rental car coverage?

- Is my camper covered for physical damage?

- What is an adequate liability insurance limit?

If you don’t know the answers to these questions but a few of them apply, you might consider talking to an insurance agent. If you don’t have a local agent, simply complete this short form or go to this page to view a list of companies.

In Summary

Cost effective Pontiac G5 insurance can be purchased online and with local Durham insurance agents, and you should compare price quotes from both to have the best selection. Some insurance providers may not have online quoting and usually these small insurance companies only sell coverage through independent agents.

When buying insurance coverage, it’s not a good idea to skimp on coverage in order to save money. In too many instances, drivers have reduced liability coverage limits only to regret that their decision to reduce coverage ended up costing them more. The ultimate goal is to find the BEST coverage at the best possible price, but do not sacrifice coverage to save money.

Additional information can be found at the links below

- Older Drivers FAQ (iihs.org)

- How Much are Car Insurance Rates for Retired Military in Durham? (FAQ)

- Who Has the Cheapest Car Insurance Rates for Teenage Males in Durham? (FAQ)

- How Much is Auto Insurance for Postal Workers in Durham? (FAQ)

- Uninsured Motorist Statistics (Insurance Information Institute)

- State Car Insurance Guides (GEICO)

- Vehicle Insurance (Wikipedia)